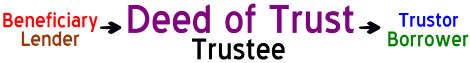

A Deed of Trust is a deed in which the title to real property is transferred to a trustee, whom holds it as security for a loan between a borrower and lender. In a Deed of Trust, the borrower is known as the Trustor and the lender is known as the Beneficiary. We show you how easy it is to fill out a free deed of trust form.

The Deed of Trust is, basically, a guarantee between a lender and a borrower, with a trustee as an intermediary, that pledges the interest in real property to secure the proceeds of a loan. A Deed of Trust is also known as a Trust Deed in certain states.

Deed of Trust or Mortgage?

A Deed of Trust is used primarily by lenders and require the borrower to provide title to the property being acquired as collateral for the loan amount. A Deed of Trust has many similarities and functions very much like a Mortgage. In fact, both act as security for the repayment of a loan by placing a lien on the property.

The differences between a Mortgage and a Deed of Trust include:

- A Mortgage is comprised of two parties – a lender and a borrower. A Deed of Trust is composed of a lender, a borrower and a trustee.

- With a Mortgage, if the borrower cannot repay the loan, the lender commences judicial foreclosure, files a lawsuit against the borrower and the case goes to court, costing everyone a lot of money. However, with a Deed of Trust, non-judicial foreclosure proceedings are exercised by the trustee and the property is then auctioned, thus skipping the courts.

A Deed of Trust is a safe alternative to a Mortgage and is becoming more popular because of the non-judicial foreclosure process used when borrowers cannot repay the loan. This process saves everyone involved time and money when compared to the judicial foreclosure proceedings used in Mortgages.

How does a Deed of Trust work?

In most transactions involving real estate, a Beneficiary, or lender, will loan a Trustor, or borrower, a certain amount of money to purchase a piece of real property. Through the application of a Deed of Trust, the borrower will then transfer title in the property to an independent Trustee, who will hold the title until the debt is repaid to the lender.

When the loan is paid in full, the trustee will then assign the title to the borrower. However, if the borrower defaults on the loan, the lender may commence foreclosure proceedings in order to obtain payment or receive title to the property.

And, just like a mortgage, when a Deed of Trust is transferred from one party to another, it must be documented and recorded in the county records office.

Even though the wording may be different in various jurisdictions, the components of a Deed of Trust are basically the same and include:

- The original amount of the loan for purchase of the property.

- A legal description of the property used as security for the mortgage.

- The names, addresses and contact information of the parties involved.

- The inception and maturity date for the loan.

- A complete listing of all the provisions of the mortgage and its requirements.

- A schedule of the assessment of any late fees.

- The legal procedures all parties will follow for any breach of the contract.

- A list of riders with any covenants or clauses that involve stipulations about prepayment penalties, adjustable rate mortgages, acceleration clauses, alienation clauses and more.

A Deed of Trust is the very best alternative to a mortgage and can be prepared online without the added expense of attorney fees. Do it yourself today and save money and time with a free Deed of Trust.

Fill out and print a free Deed of Trust form online in minutes at FreeDeedofTrust.com.